Exiting $VLO

We first covered Valero in early 2024 and bought shares at an average of $120. Since then, the position is up 34% (31% from price gains, 3% from dividends), roughly in line with the S&P 500.

We’re selling now mainly because we built a larger position in Occidental earlier this year and already have significant exposure to hydrocarbons. That said, we remain relatively optimistic on U.S.-based refiners for several reasons:

Geopolitical tensions: Attacks on refineries in Russia have already turned that country into a net buyer of refined products. This tightens global supply and makes Valero an attractive geopolitical hedge.

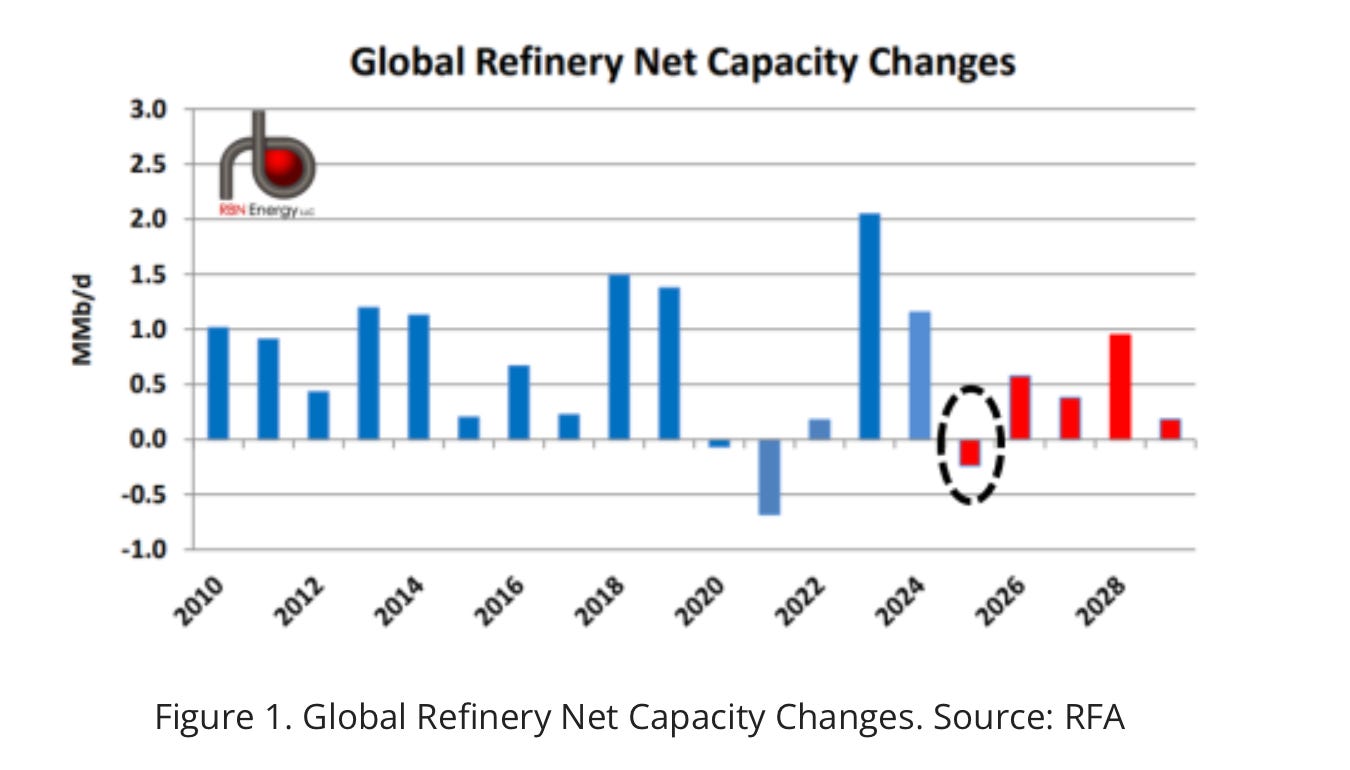

Global refinery struggles: Apart from Russia, Europe faces high costs and regulation, China’s has aging capacity with no new builds, and Latin America lags in growth. These pressures strengthen the competitive position of U.S. refiners.

Oil prices and OPEC: Trump has signaled determination to keep oil prices low, while OPEC is increasing supply. Both factors could widen crack spreads and boost refinery margins.

Financial repression: The Fed will try to keep the economy running hot, with high inflation and strong wage growth. This supports demand for gasoline and diesel.

EV adoption and electricity costs: Rising electricity demand from AI and data centers could push power prices higher. In turn, this may slow EV adoption and prolong demand for liquid fuels.

All materials produced by Reveles Research, LLC—whether posted on this site or distributed elsewhere—are supplied solely for information and education. Nothing herein constitutes, or should be construed as, investment, legal, or other professional advice. You should carry out your own analysis and due diligence before acting. Every investment decision ought to reflect your unique financial circumstances, objectives, and tolerance for risk.