Reducing $VRLA

New developments

In our last post about Verallia we flagged financing costs as a key risk. In general, Verallia carries a meaningful amount of debt. Until now, this was not a cause for concern because the company operates in a fairly stable (non-cyclical) industry and because the cost of debt was low.

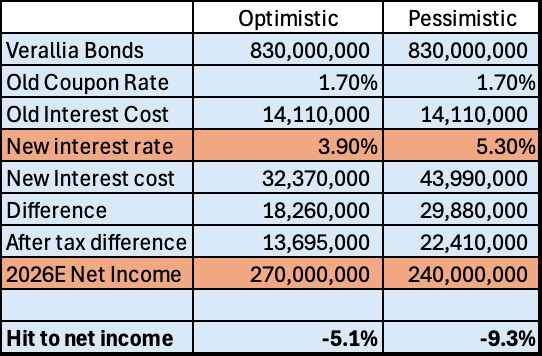

In 2021 Verallia issued €1.0bn in bonds with an average coupon of 1.75%. These matured in 2028 and 2031. However, the BWGI takeover triggered a change-of-control clause that let holders redeem early. Yesterday, Verallia announced that 830m of those bonds were redeemed—which is a higher share than we had forecast.

This pushes borrowing costs up. Debt that cost 1.7% will be refinanced at today’s market levels, which we expect to be at least 2× that rate, and possibly more. French government yields are roughly 300+ bps above 2021 levels and credit spreads are wider, reflecting ongoing and worsening fiscal concerns. As a result, we are revising our net-income outlook lower to reflect a higher interest bill.

We foresee the hit to net income being between 5% and 10%. For a low-growth company, this is significant. Therefore, we’ll be halving our position down to 8%. We currently have a 14% total return on our average cost basis (mostly from dividends and FX).

All materials produced by Reveles Research, LLC—whether posted on this site or distributed elsewhere—are supplied solely for information and education. Nothing herein constitutes, or should be construed as, investment, legal, or other professional advice. You should carry out your own analysis and due diligence before acting. Every investment decision ought to reflect your unique financial circumstances, objectives, and tolerance for risk.