Valyrian... oil?

1/2 Report on energy companies

Investment Thesis

Inflation hedge - Considering the recent positive correlation between equities and bonds, we must recognize the limited defensive qualities within our portfolio to hedge against potential inflationary spikes driven either by supply-side shocks or a resilient consumer. In light of such market dynamics, it may be a good time to increase our investment in energy and commodities. These sectors serve as effective hedges in inflationary environments and—despite not being as undervalued as last year—may warrant the current premium for their protective characteristic, which has been difficult to come by in other asset classes.

U.S. focus - Our focus should be on energy companies predominantly operating within the US and Canada, leveraging the upside potential of escalating oil prices due to geopolitical tensions, while mitigating risks associated with international asset exposure. In response to the recent military operation by the US, the Houthis have claimed that “all US, UK interests [in the region] have become ‘legitimate targets’”[1] [2].

Political tailwind - The political landscape appears to be tilting towards energy independence as a strategic priority for the US. With initiatives such as the Inflation Reduction Act supporting offshore oil and gas leasing[3], there's a clear indication of a balanced approach to regulating the industry. This would likely support continued investment in the sector despite the overarching, necessary push towards clean energy.

Outlook

Investing in oil and gas producers is challenging in large part because both volume and price of the underlying commodities are volatile—and price, especially, is notoriously difficult to predict. The EIA and other market experts are known for making poor forecasts, year after year[4]. Nonetheless, we start our analysis by looking at what they are saying:

Production

EIA projects the growth rate of U.S. crude oil production to decelerate due to a reduction in active drilling rigs, growing only 2.3% y/y in 2024, and 1.7% in 2025, with well efficiency propelling much of this growth.

JPMorgan also anticipates a slowdown in growth for U.S. oil production, though considerably higher at 4.6% y/y in 2024, before falling to a 0.7% y/y increase in 2025, as a result of industry consolidation, with Private E&Ps being acquired by Public E&Ps, which typically focus on maintaining their existing production levels (maintenance capital expenditure programs), combined with year-over-year reductions in drilling activities.

Price

EIA expects Brent crude prices to hover around an average of $82 per barrel in 2024, mirroring 2023's levels, before potentially declining to $79/b in 2025, though there is a higher than usual degree of uncertainty in these forecasts due to potential supply disruptions in the Middle East.

This aligns with JPMorgan's forecast of Brent crude averaging $83 per barrel in 2024, bolstered by OPEC+'s interventions providing a price floor at $70/b.

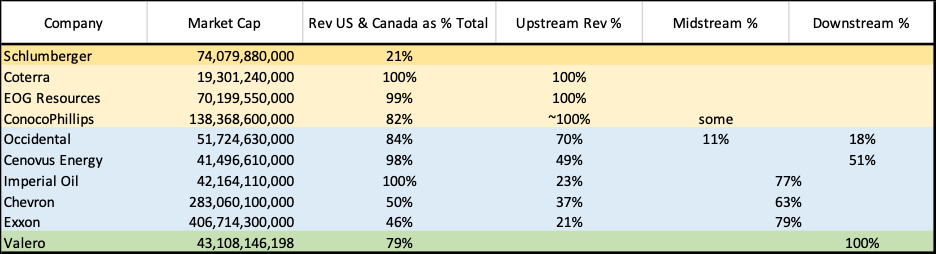

Criteria

Given that the main objectives are to provide a hedge for inflation and geopolitics, we screened for companies that met the following criteria:

1. Majority of net income coming from U.S. and Canada;

2. Upstream, downstream, or integrated companies, but avoiding pure-play midstream, which are less directly impacted by oil price fluctuations and therefore less likely to outperform in an accelerating inflationary environment.

Additionally, we looked for mid and large cap, high average ROE, and low ND / EBITDA.

Valero and ConocoPhillips stand out across all metrics. They also appear to be fairly valued when comparing Fwd EV / EBITDA to historical average valuations.

It is interesting to note that though Valero’s share price movement was much more volatile than Conoco’s (as can be seen in the time series chart), its valuation multiple had significantly lower StDev.

Upstream or Downstream?

On a theoretical level, the impact of oil prices on upstream and downstream companies varies due to the different nature of their operations.

- Upstream companies, which are involved in the exploration and extraction of oil, are more directly impacted by the fluctuation of oil prices. High oil prices generally lead to increased revenues and profitability for these companies, as the value of their primary product rises. Conversely, when oil prices fall, revenues and margins can suffer, as the cost of extraction may remain fixed or only slightly variable in the short term (i.e. they have higher operating leverage).

- Downstream companies, such as refineries, are affected by oil prices, but the relationship is more complex. These companies profit from the "crack spread," which is the difference between the cost of crude oil and the selling price of the final products (e.g., gasoline, diesel). If crude prices increase but downstream companies are unable to pass these costs onto consumers due to market conditions or competitive pressures, their margins can decrease. However, if product prices increase in line with or more than crude prices, downstream companies can maintain or even improve their margins.

Correlation with Oil

We took a look at the data and plotted the share prices of both companies against Brent crude to assess the truth behind the theory:

ConocoPhillips

Valero

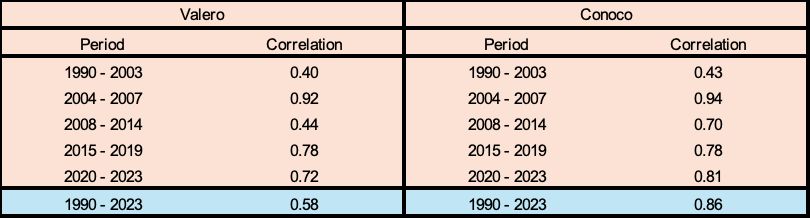

As expected, Conoco exhibits a stronger linear relationship with oil. However, it is interesting to note that since 2015, Valero’s correlation has been just as strong. We can see this more clearly when we break the data into distinct regimes:

All in all, Valero seems to be the more interesting company, with a cheaper than average valuation (on both a LTM and Fwd basis) and a high double digit CAGR over the last ten years. Moreover, its correlation with oil prices are high enough to fall within the scope of our thesis. Next, we will do a deep-dive into its fundamentals to better understand the business…

[1] https://www.vox.com/world-politics/2024/1/12/24036205/yemen-houthis-us-airstrikes-red-sea-gaza

[2] https://www.aljazeera.com/economy/2019/9/14/houthi-drone-attacks-on-2-saudi-aramco-oil-facilities-spark-fires

[3] https://www.forbes.com/sites/allanmarks/2022/08/03/inflation-reduction-act-faustian-bargain-could-jeopardize-offshore-wind-renewable-energy-on-federal-lands/?sh=c1141aa7089d

[4] https://economictimes.indiatimes.com/markets/stocks/news/dont-pay-heed-to-commodity-prophesies-theyre-always-wrong-aswath-damodaran/articleshow/69199766.cms?from=mdr