Verallia Update

Lower gas costs will drive higher-than-expected earnings growth

We last wrote about Verallia back in January. To recap: Verallia is a French maker of glass bottles and jars, serving mainly the wine and spirits industry, but also food and soft drinks. With 90% of its sales coming from Europe, it is the continent’s largest supplier and the world’s number-three producer of glass packaging.

Our attraction to this business has not changed. Glass is heavy, fragile, and costly to haul over long distances, so each region ends up with only a handful of furnaces; that scarcity means that competition is limited and the glass manufacturers generally have the upper hand over their customers (fragmented wineries, in this case).

Though total output as measured by volume might remain flat, prices can easily keep up with (even exceed) inflation. Across the cycle, we expect revenues to grow at a 3% rate—a comfortable though mediocre result. However, there are other tail-winds that will push earnings growth decidedly higher.

When valuing energy-intensive businesses (cement manufacturing, aluminum smelting, steel production, fertilizer plants, pulp & paper mills) any investor should first assess its cost structure. These industries rely heavily on different sources of fuel and a cost advantage/disadvantage can determine a company’s long-term profitability.

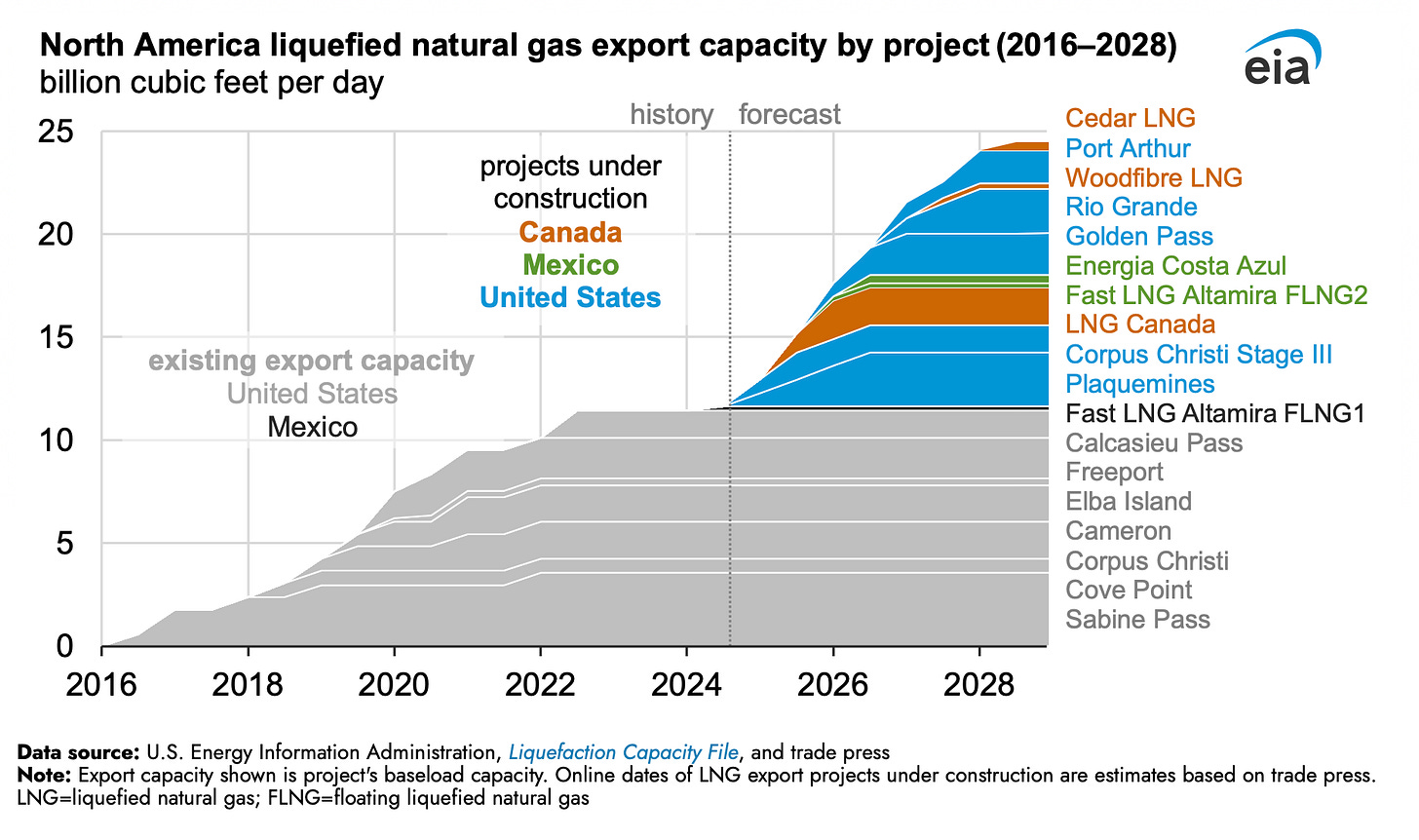

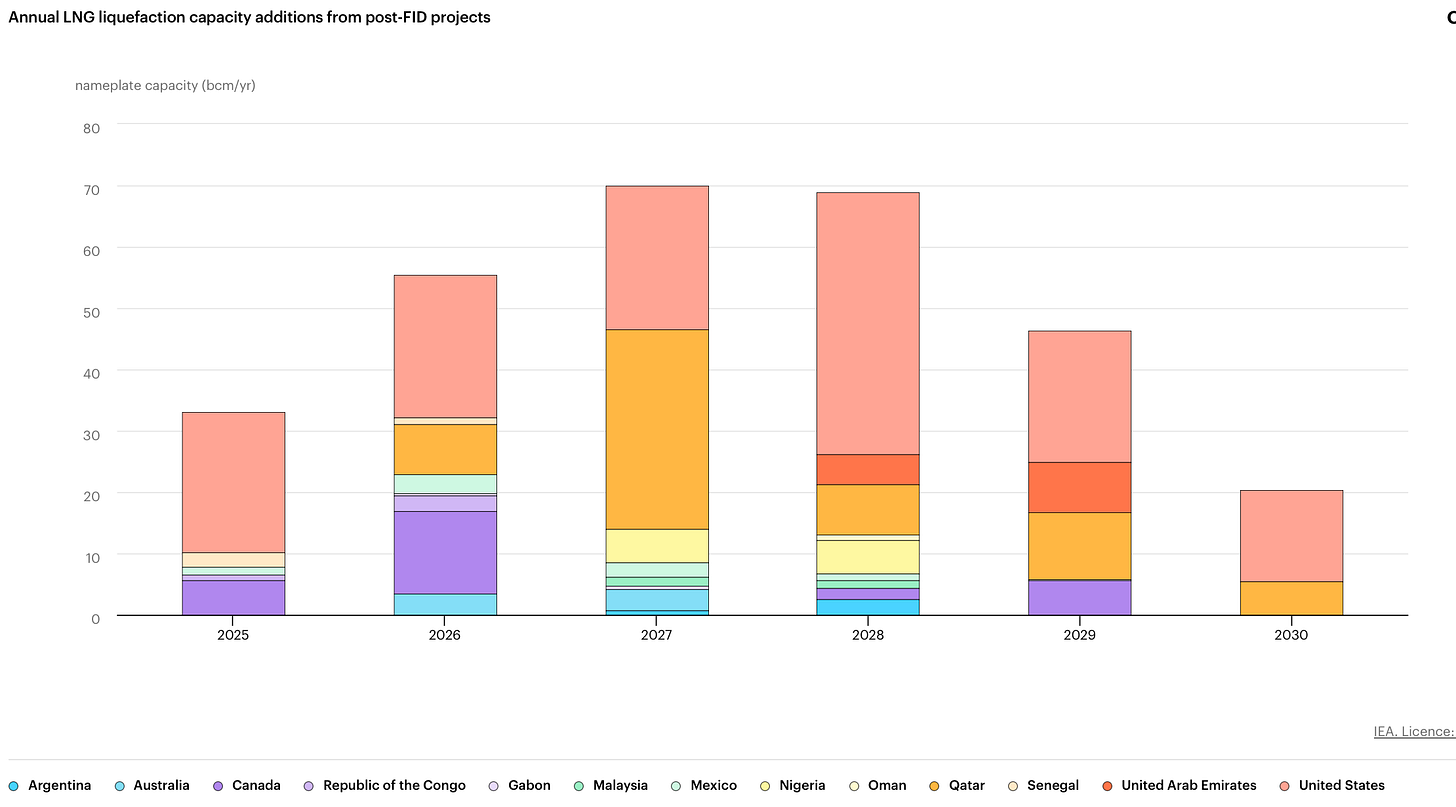

For glass manufacturers, natural gas is the main consideration: running a furnace accounts for roughly 30% of production costs. Ultimately this is the reason for our optimism. Over the next three years the US will unleash the biggest single wave of new LNG capacity Europe has ever seen. Three Gulf-Coast plants begin shipping cargoes from late-2025, a near-50% jump on today’s U.S. export capability.

[This capacity does not include the recently announced trade deal, which is at the moment no more than a vague commitment from the EU to buy as much as US $750 billion of American energy. Although, according to the Financial Times, “hours after Trump and Von der Leyen announced the trade deal, Venture Global, an US LNG exporter with multiple European contracts, said it was moving ahead with a $15bn project to produce 28mn tonnes of LNG a year — equivalent to almost half of Germany’s current gas demand.”]

Qatar follows close behind with its two-phase North Field East and South expansion, which will make it the EU’s second-largest non-Russian gas supplier after the US. There is also, of course, the possibility of a detente with Russia but we are not holding our breath for that.

Cheaper gas should feed straight into Verallia’s cost base and, so long as its pricing power remains intact (which we think it will), allow the company to keep at least part of those savings, boosting margins.

While on the topic of pricing power—there was news in March that France’s Competition Authority raided Verallia and peers on suspicion of price coordination—an unwelcome headline but, for us, confirmation that its pricing power is real.

Verallia’s press release notes that such inspections do not imply that the company has broken the law. No statement by the Authority has yet been issued. The regulator itself reminded the public that a verdict “can only be established following an investigation on the merits,” and trade-press coverage points out that cases of this type typically require years to progress and result in only a modest fee if anti-competitive behavior is indeed proven. We are not worried about such an outcome because we believe the favorable environment is readily explained by economics, not nefarious behavior.

Now for the big news: In February, BWGI—a Brazilian family office that has owned 28% of Verallia’s shares since 2019—filed a voluntary tender offer with the goal of becoming majority (and therefore controlling) shareholder. BWGI is offering €28.30 per share, essentially to anyone in the market who is willing to sell theirs.

By July 28th, enough shares had been tendered for BWGI to lift its stake to roughly 70%, handing it majority control of the glass-maker. Any remaining shareholders who wish to tender their shares have until August 13th to do so.

Importantly, BWGI pledges to leave the company listed without forcing an acquisition of un-tendered shares for at least three years (i.e. remaining shareholders will not be squeezed out). In addition, BWGI’s offer document states that it “does not intend to change the company’s dividend distribution policy” over that period.

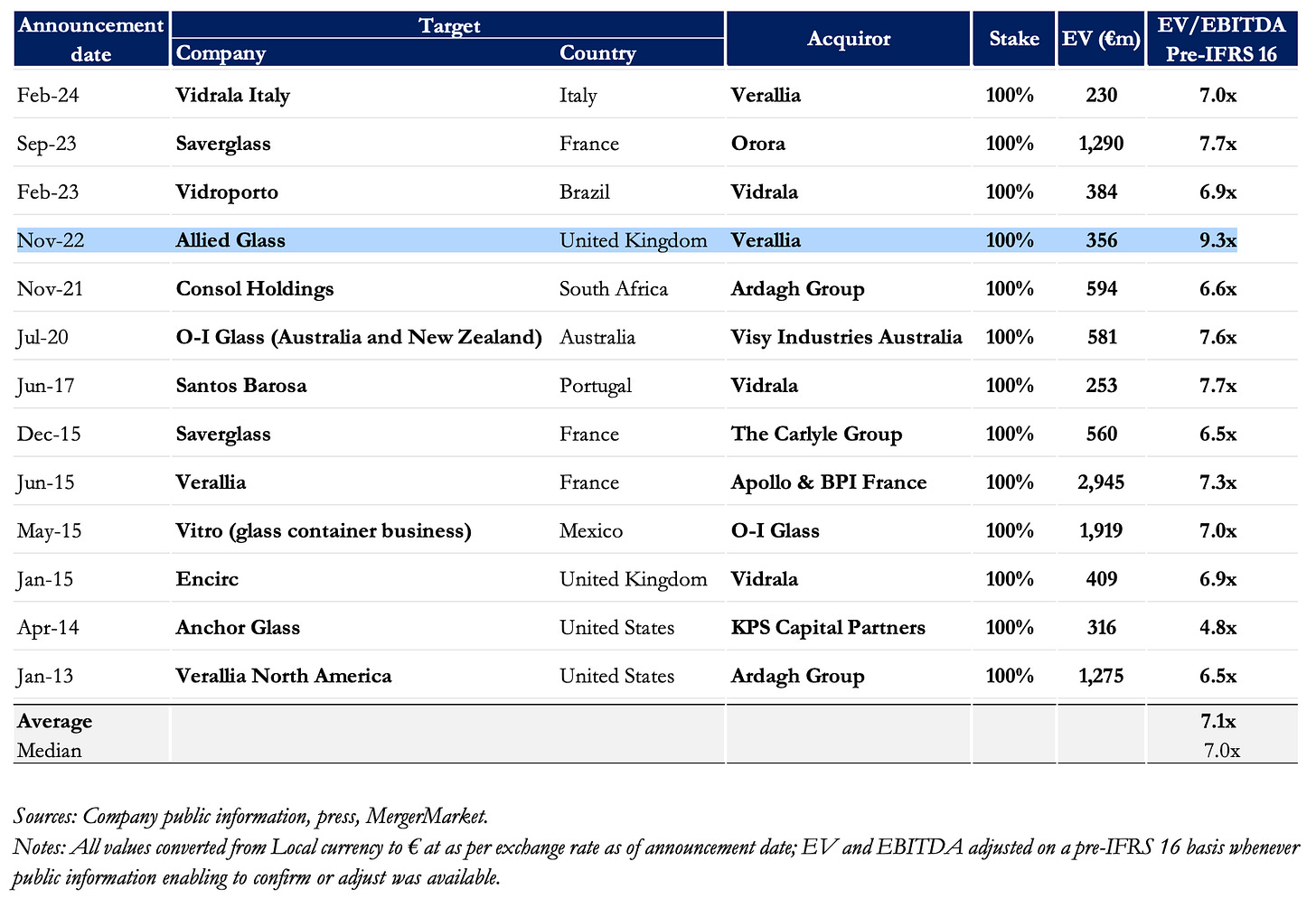

Governance was one of our main worries when we initiated our position last year. It is a bad sign when managers of a cyclical company do not have a handle on the underlying business cycle. Verallia’s managers, misreading the post-pandemic boom in earnings as a structural shift in demand (which of course it was not), decided to buy Allied Glass in late 2022 for an eye-watering multiple (see table below) at the top of the cycle. High valuation on peak earnings. Ouch.

Now, with BWGI about to become the controlling shareholder, we have greater confidence that management will be forced to be more disciplined. Therefore, this development in our eyes is positive for all shareholders.

Risks remain. At the top of the list are financing costs. Due to the agreements with existing bondholders, a change in control of Verallia allows them to redeem their bonds. An independent expert who reviewed the deal estimates that the cost to refinance would be €0.40 per share in a worst-case scenario—i.e. all one-off fees that could hit Verallia if every bondholder, every bank, and every factoring counterparty demanded repayment.

Historically only a fraction of investment-grade bondholders tender on change-of-control clauses, so the cost would probably be far lower. In addition, banks have already agreed to not force a redemption so it’s just the publicly listed bonds that are currently uncertain.

Overall, in our view, the risk-reward has improved since January with what we expect will be a more disciplined owner. The BWGI tender offers shareholders a floor while we wait for the gas-cost story to play out over the coming years.

We initially put in a 13% position which has since grown to 16% of our overall portfolio. Though the position is significantly overweight, we won’t be tendering our shares as we believe this is still one of the best investment opportunities we have found.

All materials produced by Reveles Research, LLC—whether posted on this site or distributed elsewhere—are supplied solely for information and education. Nothing herein constitutes, or should be construed as, investment, legal, or other professional advice. You should carry out your own analysis and due diligence before acting. Every investment decision ought to reflect your unique financial circumstances, objectives, and tolerance for risk.