Allison Transmission

Transmitting value...

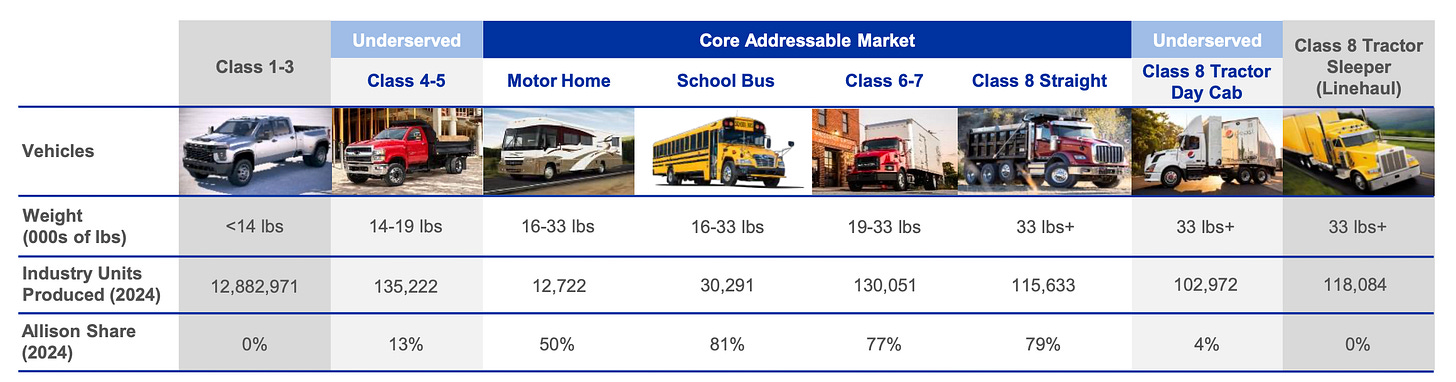

Allison ($ALSN) makes automatic transmissions primarily for medium-duty trucks, which are commercial vehicles like fire trucks, delivery trucks, cement-mixers, refuse haulers, buses, etc.

This category of trucks (Class 5-7 and Class 8 straight) are also known as vocational vehicles and demand for them depends mostly on infrastructure and construction activity and, to a lesser extent, on municipal budgets. Allison does not sell to long-haul tractors (Class 8 line-haul).

The reason for this is that vocational trucks make frequent stops and therefore need to shift gears constantly, whereas long-haul trucks do not. An automatic transmission uses a computer to handle these shifts and to smooth out power delivery, which makes driving easier and saves fuel in stop-and-go work.

Since long-haul trucks run mostly at steady speeds, there is not much advantage to having an automatic transmission. For them, manual transmissions cost less (both in upfront costs and over the vehicle’s life).

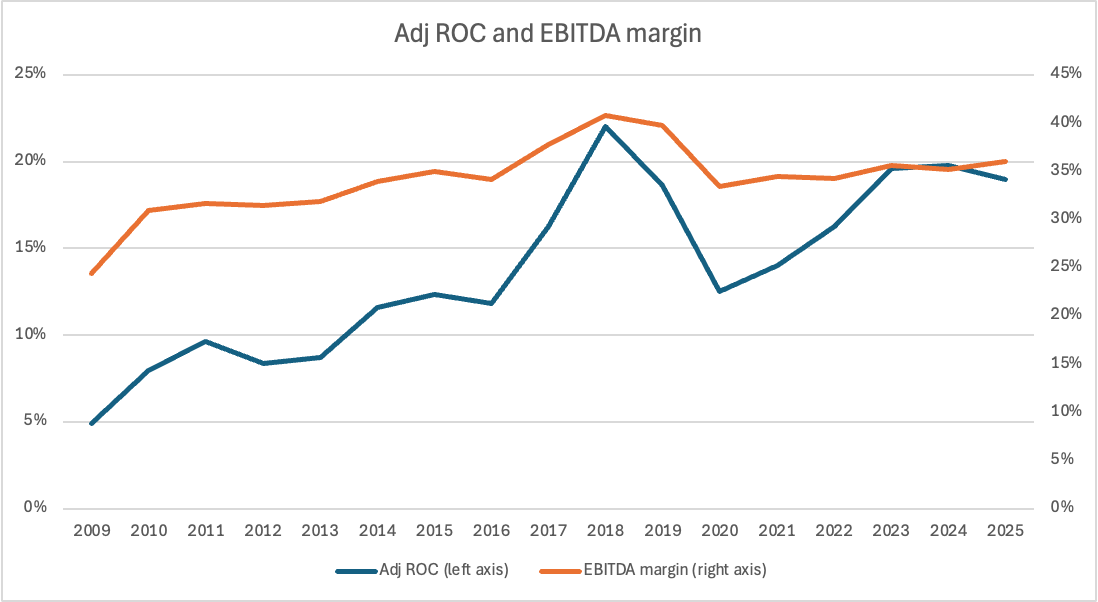

Allison sells primarily in the US where it has an 80% market share in transmissions. That is practically a monopoly. The company’s dominant position is reflected in its high margins and high returns on capital.

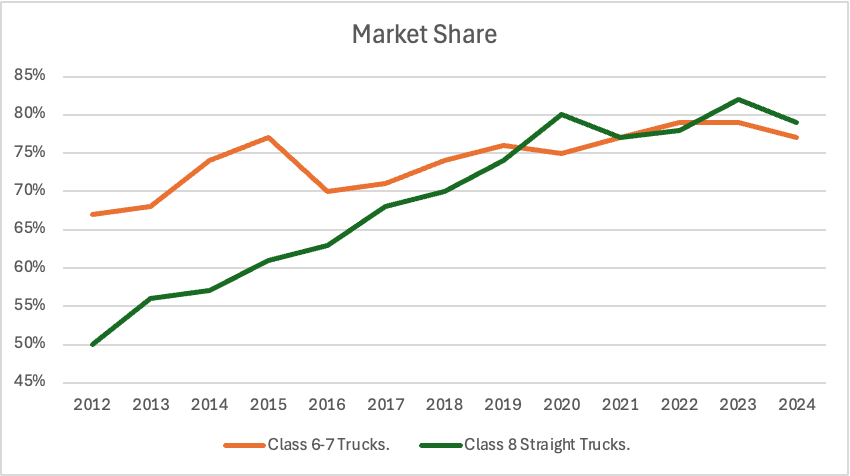

In its main categories (Class 6-7 and Class 8 Straight, which make up 80% of revenue), its market share has been growing significantly over the last decade.

The graph above depicts Allison’s market share in all transmission categories, not just automatics. Given these metrics, it’s fair to say that Allison is not your typical vehicle-parts supplier. But what makes it such an unusually strong player?

We believe the answer lies in the market’s wide range of vocations (emergency, delivery, construction, agriculture, refuse, defense, transportation, etc), where each application demands a transmission with its own software calibration.

Developing and maintaining these thousands of calibrations creates a big fixed-cost burden. A specialist like Allison spreads those costs across many OEMs and vocations, so each individual truck program carries only a fraction of the total expense.

Over the years there have been some attempts to challenge Allison’s position but they have mostly failed:

Eaton in 2014 launched Procision to compete with automatics in medium‑duty applications; by 2019 it had discontinued the product.

Caterpillar in 2011 launched its own line of vocational trucks with proprietary automatics; the program was canceled in 2016.

ZF, which is Allison’s main competitor in Europe, markets PowerLine in the US as an automatic for medium‑duty trucks. Penetration to date is limited.

That said, vertical integration from OEMs is a possible risk. For example, as part of a refresh in 2016, Ford started equipping its medium-duty vocational trucks with in-house transmissions, which continues to this day. Given that the general trend has been in the other direction (towards third-party outsourcing), we believe the risk of a large scale reversal is low.

So, where have Allison’s gains in market share over the last decade come from?

Mainly at the expense of manual transmissions (and AMTs, a third category of transmission type). End-users have increasingly valued fuel efficiency and smoother shifting, which has supported a secular shift away from manuals/AMTs in the US.

Today, the market is concerned that there may be another secular shift underway, one which would undercut Allison’s business model: we’re talking of course about electrification. Let’s look at the numbers.

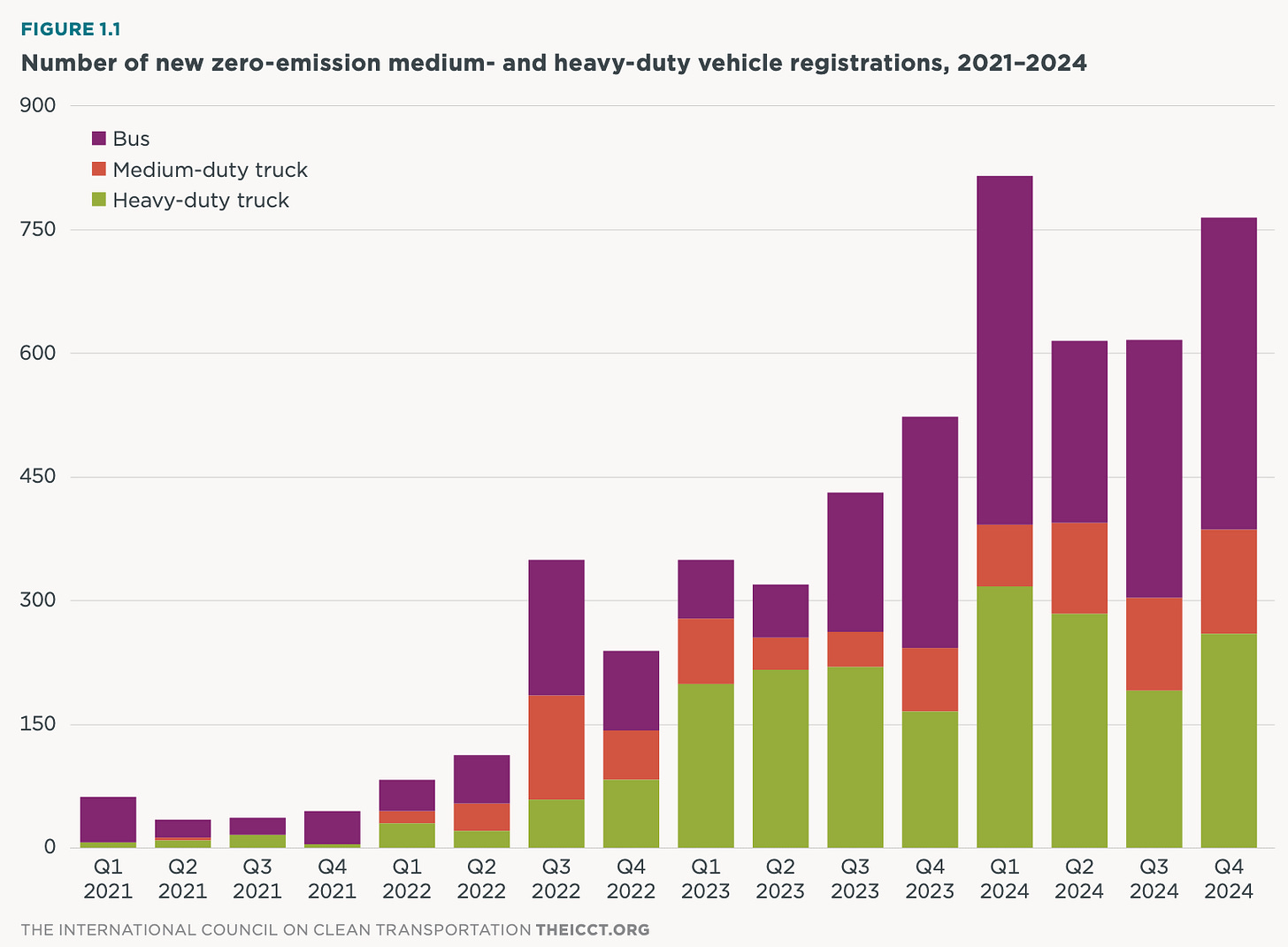

In 2024, zero-emission vehicles in the US accounted for 0.18% of medium-duty truck registrations, 0.40% of heavy-duty truck registrations, and 7.0% of bus registrations.

These are tiny numbers, especially in Allison’s core markets. And there is good reason to think that they will remain tiny (albeit growing) for a while.

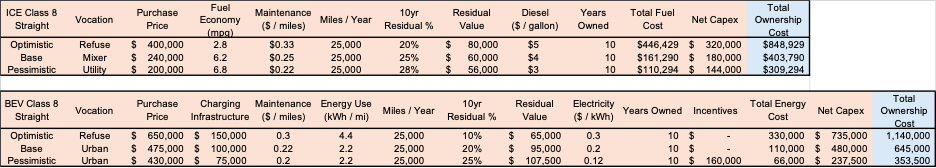

We asked ChatGPT to help us estimate the cost differential for a business buying a truck with an internal combustion engine (ICE) versus an electric one (BEV). We’ll put the full calculations in a footnote1.

In summary, over the course of 10 years, the total cost of ownership (TCO) for the average Class 8 vocational truck is about 400k, assuming a purchase price of 200k, a residual value of 25%, and diesel at $4 / gallon.

For BEV, the TCO is 645k, which amounts to a 60% premium. This doesn’t include any government incentives, which can narrow that gap down to 20-25% (more common for municipal vehicles). Nevertheless, it’s a wide differential.

The reality is that trucks require very large batteries. Undoubtedly, market forces will one day bring down their cost sufficiently to make BEVs competitive, but it won’t happen any time soon. What’s more, higher electricity prices from heavy AI usage might prolong the transition.

So Allison may not face any near-term competition or threat, but are there any opportunities for growth in its future? Indeed there are…

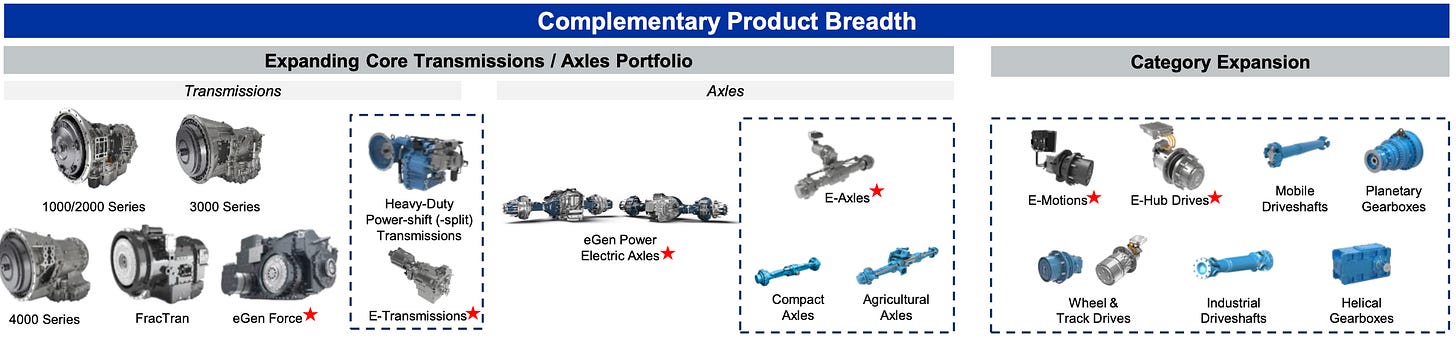

In June of this year management announced a $2.7 billion deal to acquire Dana’s Off‑Highway business, a global operation that supplies axles, drivetrain components, and propulsion systems for construction, mining, agriculture and other off‑highway markets.

In general we are wary of large, transformative acquisitions; in this case, however, it seems to make a lot of sense. For starters, 90% of Dana’s Off-Highway products are not transmissions, meaning they mostly complement Allison’s portfolio.

Secondly, 70% of Dana’s sales are outside North America, while Allison’s are 70% within NA.

And thirdly, Dana’s customer base is mostly Off-Highway (construction, mining, agriculture), whereas Allison’s core business is in On-Highway (urban vocational).

Allison can therefore leverage Dana’s (1) complementary products; (2) complementary geography; and (3) complementary customer base & distribution channels, to cross-sell its own higher-value transmissions.

In some emerging markets, the acquisition could also help Allison push its automatics in places where manuals still dominate, and potentially repeat the success it achieved in the US.

More importantly—it bought all this for a very reasonable price of 10x P/E! Looks like Dana got itself into a bit of a pickle with debt and was in a hurry to sell off some assets…

Turning now to Allison’s valuation: what are we looking at? Using conservative assumptions, we struggle to come up with a fair value below $100/share. The stock is now trading around $82. That’s a good margin of safety. We wouldn’t be surprised to see this company trading at $150 in a couple of years.

A note on debt: Allison will be taking on more debt for the Dana acquisition. We estimate interest coverage post-closing will be 6x, which is depressed but not overly onerous.

Something we haven’t mentioned is Allison’s after-market parts franchise (20% of sales), which provides the company with a steady, high-margin, counter-cyclical stream of earnings that should support interest obligations even in a downturn. Given this, we are not concerned about the debt level as strong FCF should allow for quick de-leveraging.

Near-term risks to be aware of involve tariffs and new emissions standards:

The EPA will tighten nitrogen‑oxides (NOx) limits for new heavy‑duty engines starting with model‑year 2027. Historically, fleets pull forward purchases ahead of big emissions regulations, so this could boost demand in 2026 and dampen it after that.

In June 2025 Trump raised most Section 232 duties to 50% on covered steel and aluminum imports. Transmissions are metal‑intensive and so higher costs flow through the supply chain. Though Allison’s contracts are index‑linked (it passes through commodity inflation), general vehicle demand could be affected.

Allison is currently trading at a Fwd. P/E of 10x. At this price, we’re excited to make it a core position in our portfolio.

All materials produced by Reveles Research, LLC—whether posted on this site or distributed elsewhere—are supplied solely for information and education. Nothing herein constitutes, or should be construed as, investment, legal, or other professional advice. You should carry out your own analysis and due diligence before acting. Every investment decision ought to reflect your unique financial circumstances, objectives, and tolerance for risk.