Consumer Packaged Goods

A yummy idea

We continue to see the biggest risk in 2024 to be the positive correlation between stocks and bonds, and the difficult challenge that persistently high inflation would present to the traditional 60/40 portfolio.

So far, inflation has declined as quickly as it surged, largely thanks to a one-off boost from supply-chain improvements and labor force participation, which increased the overall supply of goods and services, and by the Fed’s restrictive policy, which impacted demand. Both effects are now fading away, or have already.

The Fed’s anticipated rate cuts have eased financial conditions dramatically. We wonder if this will not inadvertently spark a fresh wave of demand in the US and bring back the old fear of inflation into the market.

We have been closely tracking the chart above which shows the financial condition’s index (blue line) plotted against the month-over-month change in sticky price core CPI—i.e. it’s the second-order derivative of a measure of prices that are particularly slow to change (red line). Since March of last year, financial conditions have relaxed significantly, while the rate at which inflation is slowing has itself started to slow. In other words, sticky price inflation is still coming down, but not as quickly as before. And the full effect of the Fed’s pivot has yet to be felt on the economy.

The Path Ahead

If this comes to pass—if inflation remains stuck at a high level or even reaccelerates—Treasury yields will undoubtedly rise but by how much will depend on how the Fed choses to react. Powell will have two options. The first, and more likely of them, will be to reiterate his data-dependency and wait for longer than the market expects to deliver on the rate cuts. The hope would be that conditions tighten back up again enough to slow the economy, and thus inflation with it.

The alternative approach would be to signal that the Fed is not yet done raising rates—a more aggressive way to tighten, which might finally induce a recession. However, unless there’s a significant reversal in the inflation trends observed over the past year, we view this scenario as unlikely. Given the Federal Reserve’s mandate, high inflation that is neither rising nor falling is unlikely to warrant the risk of job losses from over-tightening, especially in an election year1.

How does the first scenario play out, then? For starters, it means continued volatility. It also means that both equity and bond markets are particularly vulnerable. In such an event, the companies poised to outperform are those that can lay claim to some degree of pricing power, allowing them to preserve or enhance profit margins in the face of higher input costs.

Consumer Packaged Goods

In theory, a rational, profit-seeking company will try to optimize sales by increasing prices without excessively hurting demand for its products. The more inelastic the demand is in response to price changes, the greater leeway the company has to implement price hikes.

Historically, consumer packaged goods have been shown to have strong inelastic demand, with consumers continuing to buy approximately the same amount of product regardless of changes in its price. Several factors—such as brand loyalty, the product being a necessity, or its cost being a small portion of the consumer's overall budget—can drive this dynamic.

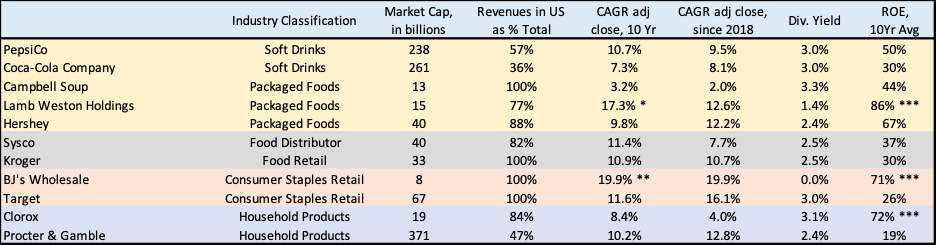

We screened for a variety of CPG companies in food, beverages, and household products. We also included some retail companies in the mix for comparative purposes.

* since 2017

** since 2018

*** since 2020

To mitigate the risk of a stronger dollar’s impact on the top-line, we can exclude companies generating over ~50% of their revenues from outside the US. Off the bat, this eliminates Coca-Cola and P&G.

We also eliminate Target which, in our view, appears to be susceptible to rivalry from cost-effective Chinese platforms. Based on anecdotal observations, we've noticed a shift in shopping habits among our three teenage nieces. Whereas in the past they used to be regular shoppers at Target, they now seem increasingly engaging with (and spending money on) platforms like Shein and, especially, Temu.

Next, we turn to valuation metrics:

Campbell Soup’s high PEG Ratio and low CAGR points to investor skepticism about the company’s future growth prospects. Clorox’s stock underperformance and over-valuation relative to historical averages is also not particularly attractive.

This leaves us with: PEP, LW, HSY, SYY, KR, and BJ.

Margins

Below, we compare Operating Margins among the remaining companies in relation to the overall Consumer Price Index (CPI), to see how well they hold up.

Not surprisingly, during 2020 and 2021 the margins of Sysco and LW faced challenges, as they mainly serve restaurants which were impacted during lockdowns. Most impressive are Hershey’s and BJ’s whose margins have been on a steady long-term uptrend, defying inflationary pressures.

We’ll be taking a closer look at some of these companies in the coming weeks…

The content provided by Quits & Starts, including all materials on this website, in the newsletter, and in any other communication from its author, is strictly for informational and educational purposes. It is not intended to be, and should not be interpreted as, investment, legal, or any other type of advice. Readers are encouraged to conduct their own research and due diligence. It's important to remember that investment decisions should be tailored to an individual's specific financial situation, goals, and risk tolerance.

“The record of the current Fed leadership and political donations of Fed staff indicate a left leaning preference, suggesting an emphasis on employment over inflation.”

https://fedguy.com/doves-ascendent/