Cultivating Patience

Over the years, people have often asked Buffett what sets him apart from the typical investor. His reply never changes, and he always delivers it with his characteristic sense of humor. It’s not brilliance or cold logic, he insists—not ambition, nor timing. His edge is patience:

“No matter how great the talent or effort, some things just take time: You can’t produce a baby in one month by getting nine women pregnant.”

Of course, one must be brilliant and logical in the first place to possess the confidence to be patient! But Buffett suggests it is the last element, above all others, that’s hardest to achieve.

And perhaps that’s also why it’s so rare today—patience has become a dwindling resource in a culture that prizes speed over reflection. A recent study found that the share of Americans who read for pleasure has fallen by 40% over the past two decades. No time for deeper thought; we want instant gratification!

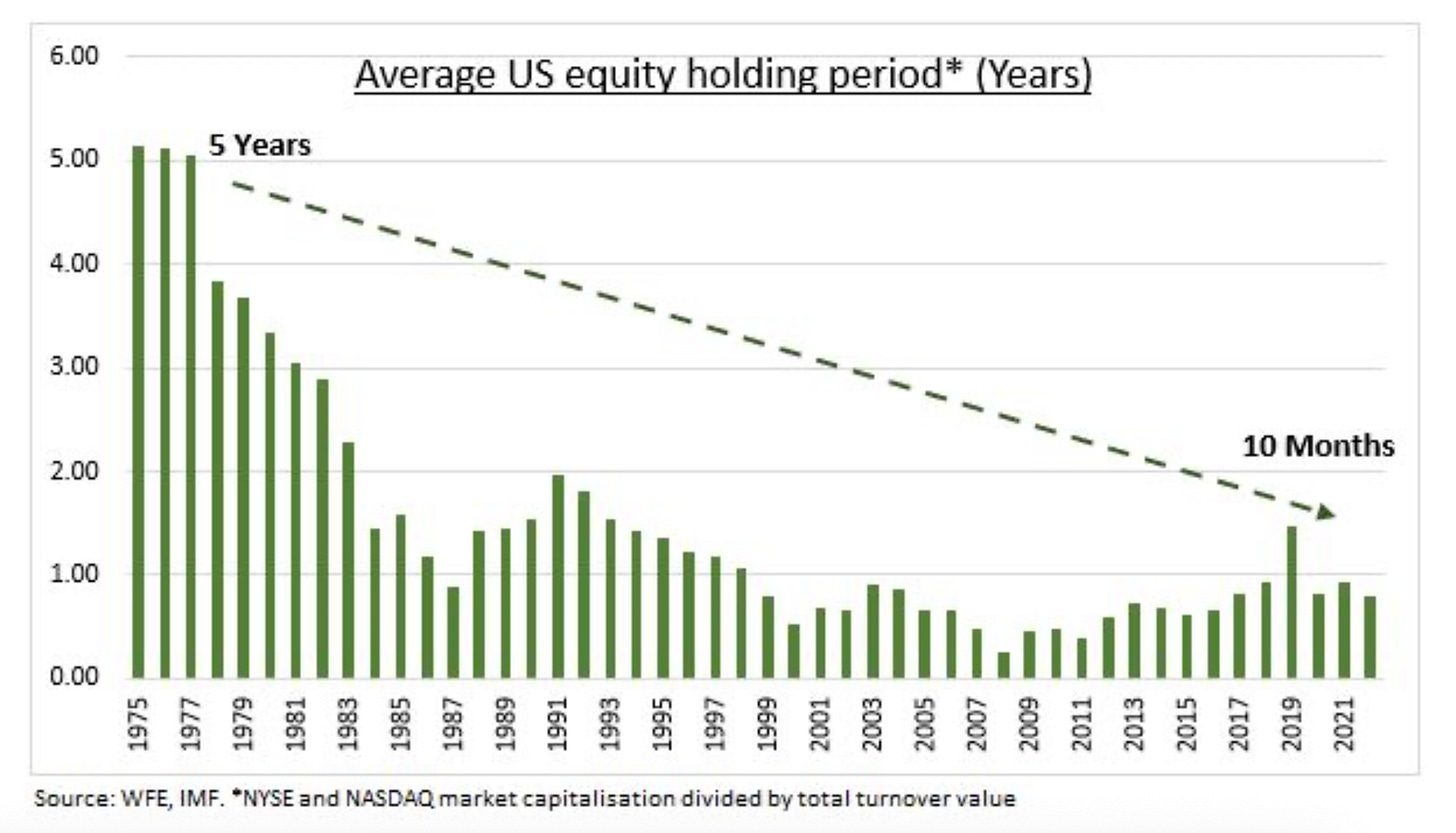

Jack Bogle, founder of the Vanguard Group, noted that the average holding period for stocks has collapsed to less than 10 months, down from about 5 years in the 1970s. Without any great insight on our part, we can point to several likely culprits: persistently low rates, online retail trading, social media, among others.

The trouble is that these forces don’t just shorten horizons—they also feed into market behavior. Too-frequent trading leads to a distortion of prices, where securities are principally valued on momentum, not on fundamentals. It’s the mechanism by which expensive shares become even more expensive, and how investors end up over-paying for growth.

When we launched this newsletter a year and a half ago, our goal was simple: identify 10 companies in which we had a strong conviction, hold them for three or more years, and spend that time deepening our understanding. We would then share what we learned with our readers—not necessarily as investment advice, but as case studies in how to sharpen one’s thinking about businesses.

Progress has been slow—and that’s as it should be. Stocks are expensive all over the world and it is getting harder and harder to find bargains. So far we have built up only four core positions: Verallia, Greggs, Aumann, and Occidental. The first three we’ve written about. The last one we haven’t (for obvious reasons—there’s plenty of analysis out there already—what more is there to say?). Collectively they make up just shy of half our portfolio.

We also own a smattering of smaller holdings (Lantheus, Valero, Nvidia, Meta, Amazon), which we will look to sell eventually because we want to concentrate into larger positions of between 8-12%. As Druckenmiller is reported to have said (quoting loosely from memory): “Put all your eggs in one basket and then watch that basket very carefully.”

Recently we’ve considered (and then dis-considered) adding to the basket: a pharma distributor in Japan, a mid-cap supermarket in the U.S., an exhibition organizer in Italy, a provider of infrastructure maintenance services in Australia, among many others. No matter, we’ll just keep looking. We’re in no rush. If nothing else, our search has given us greater confidence in those companies that we have chosen.

In the next year or two, we have absolutely no idea what will happen to the stock prices of Verallia, Greggs, Aumann, and Occidental. But in the longer-term we have a high level of conviction that the underlying business of those companies will do well and that (hopefully) stock prices should follow.

Which brings us back to the point about patience. If this newsletter is to be truly useful to anyone, we believe it’s just as important to write about our mistakes as our successes, if not more so. One recent mistake was a lapse in patience. After spending the past year developing our view on Verallia—knowing the company inside and out—it took only a single day for us to announce we were cutting the position in half.

Thankfully we did not end up cutting it in half. On August 26th, when Verallia issued a press release detailing how the majority of bondholders had chosen to redeem their bonds, we were caught off guard. In our haste, we wrote a quick post and sold 1% before the market close. Only after sleeping on it did we start to question whether we had succumbed to “short-termism.”

The reality is that we had originally valued Verallia on an ex-growth basis, leaving plenty of margin for error. This is a company that generates a ton of cash, and a 5% or 10% hit to earnings shouldn’t materially change the picture. What difference does it make if our dividend yield comes in at 6.5%, 6.2%, or even 6%? The fall in the stock price had already compensated us for that shortfall.

Of course, we could end up being wrong yet again! But if we are then we will be sure to write about it here.

All materials produced by Reveles Research, LLC—whether posted on this site or distributed elsewhere—are supplied solely for information and education. Nothing herein constitutes, or should be construed as, investment, legal, or other professional advice. You should carry out your own analysis and due diligence before acting. Every investment decision ought to reflect your unique financial circumstances, objectives, and tolerance for risk.