Hedging the Pound

And loading up on $GRG

Yesterday morning, Gregg’s issued a profit warning, saying H1 2025 operating profit will “modestly” undershoot last year’s performance. Lower than expected sales amplify the impact of front-loaded shop refurbishment costs, as fixed expenses are spread over a smaller revenue base.

The stock was down 15%. We took the opportunity to increase our position to 12% of our portfolio, as this is a company we continue to be very excited about.

However, given the state of the UK’s public finances, we also decided to fully hedge our sterling exposure. What the country currently owes in public debt is nearly as much as the entire economic output of one year (~95% of GDP).

More worryingly, the annual cost to service that debt is now rising faster than the pool of money available to pay it: while the government pays out about 4.5% interest on 10-year gilts, the economy (and with it, the tax base) is expected to grow only at about 4.2% in nominal terms.

That might seem like a small difference — just 0.3 percentage points — but there are significant risks that could widen the gap further.

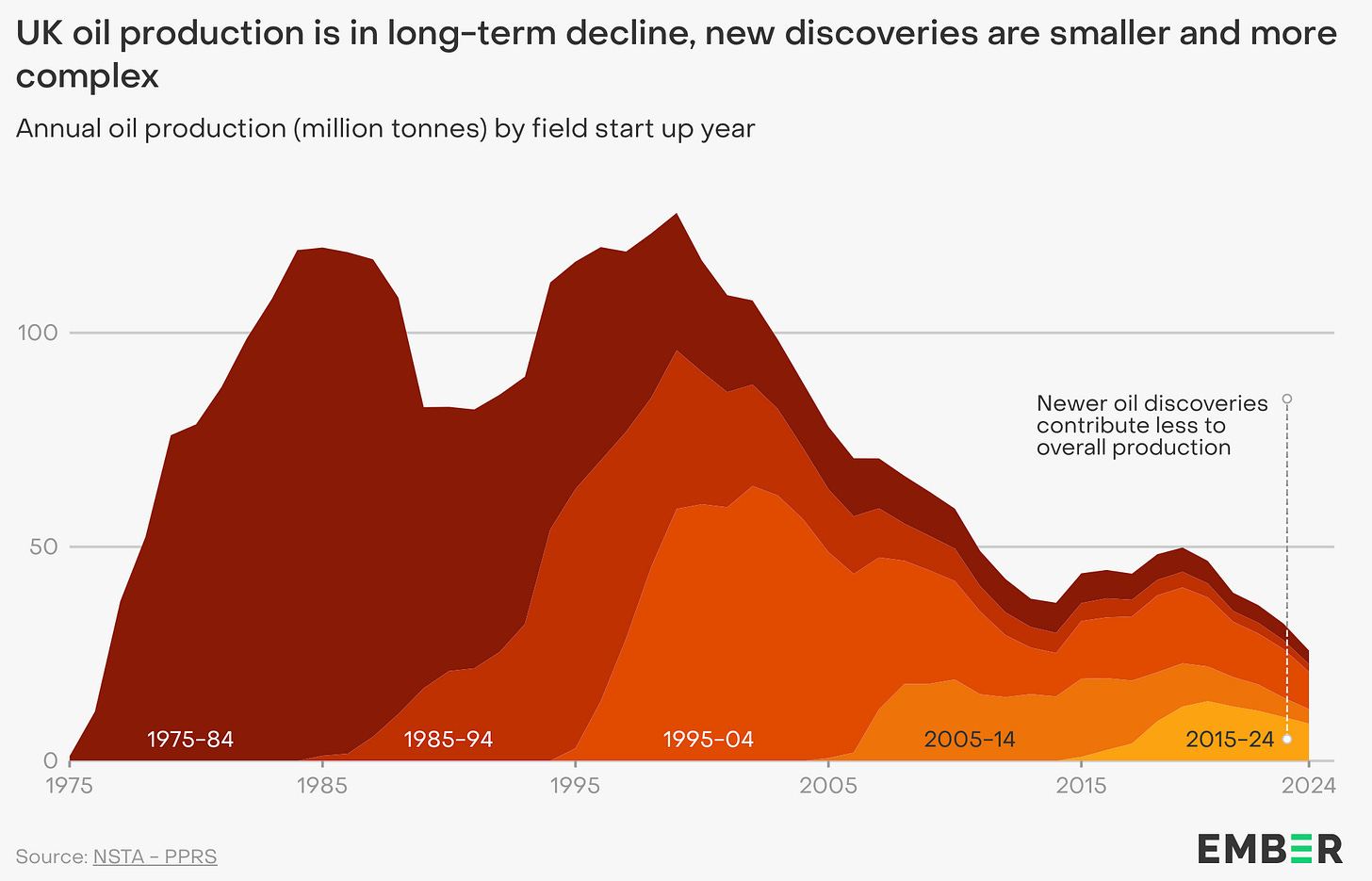

At the top of the list is an oil price shock, which matters for the U.K. because the country is over-reliant on energy imports:

“The UK’s oil and gas production is in long-term decline, with a 68% drop between 2003 and 2023. Without an equivalent reduction in fossil fuel demand, UK exposure to import price shocks is set to increase… In total, the UK imports 40% of its energy supply.”

Every extra dollar spent on a barrel of oil means more pounds must be sold to buy foreign fuel, weakening the pound. Not only that, but higher oil prices push up inflation—and thus yields—while simultaneously squeezing growth.1

High debt levels and energy dependence seem to be long-term structural issues that we would like to hedge against. Below are a couple of ways to do that through IBKR (one is simpler but more expensive than the other).

IBKR’s “cash‑hedge”

To go this route, you essentially want to create a negative GBP cash balance inside your Interactive Brokers account by selling £ against USD. The short‑GBP cash offsets the £ value of your Greggs shares.

The “carry cost” would be the differential between the rate you receive in USD vs what you owe in £, which is posted daily. Right now you pay about 5.2% to borrow pounds and earn about 3.8% on the dollar rate. The net carry therefore is 1.4%. That is your total cost.

The risk with this strategy is if UK rates increase while US rates decrease then the differential widens. Even a 3% spread is not extreme, but it does reduce the efficiency of the hedge for retail investors.

Because the cost of holding this hedge rises as the interest rate spread widens, this method is more suitable for hedging currency risk unrelated to interest rate movements. When the primary source of risk is the interest rate differential itself—as it is in this case—the strategy becomes less effective. This is why we prefer option #2, outlined below.

Enable margin and forex trading permissions in settings

Trade GBP.USD and sell the number of pounds you want to hedge (equal to the Greggs position size)

Short FX futures

A cheaper—and preferable—alternative is to use futures contracts. With a futures contract, you lock in today the exchange rate at which you will buy or sell the currency at a specified future date. In this case, because you are hedging against a decline in the pound, you would sell GBP/USD futures. This approach eliminates the uncertainty of future exchange rate movements.

Unlike the cash-based hedge, this method does not require you to borrow pounds or manage a negative cash balance. Instead, you simply post a small amount of margin—typically around 4% of the contract’s notional value—which functions as collateral.

The total cost of this hedge is minimal. You’ll pay a small transaction fee to the futures exchange (usually around 0.01%). Your only other cost is the opportunity cost of the collateral you’ve posted.

If we assume a 10% expected annual return on capital elsewhere, the implied cost of tying up 4% in margin is 10% × 4% = 0.4% per year.

Enable futures trading permissions in settings

Open a fresh order ticket → Order Ticket → Futures tab.

Type M6B → Select Dec 2025 from the month drop-down.

Enter your sell order

All materials produced by Reveles Research, LLC—whether posted on this site or distributed elsewhere—are supplied solely for information and education. Nothing herein constitutes, or should be construed as, investment, legal, or other professional advice. You should carry out your own analysis and due diligence before acting. Every investment decision ought to reflect your unique financial circumstances, objectives, and tolerance for risk.

Especially since about a quarter of the government’s debt is index‑linked to the Retail Price Index, so coupons jump automatically when energy‑led inflation climbs.