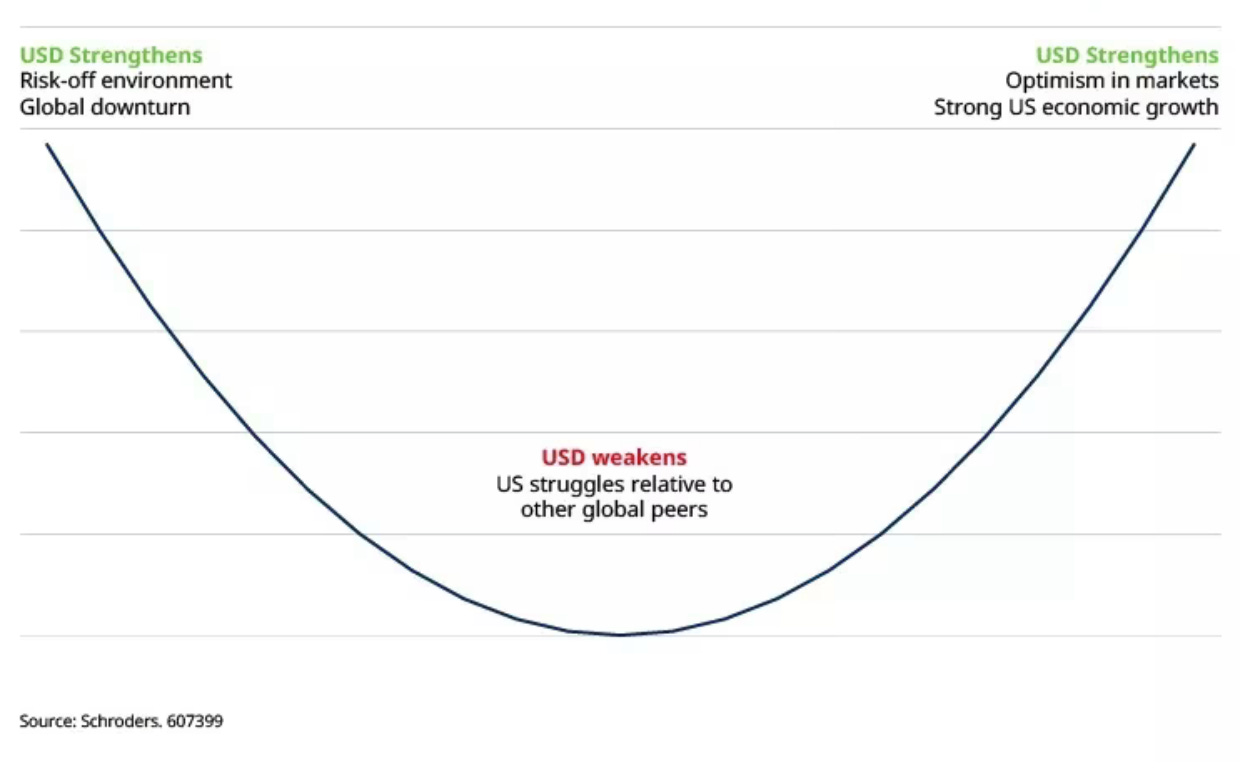

The Dollar Smile

Hedging the euro

Currencies are notoriously hard to predict and we claim no special skill in this area. Still, given where things stand, we’ve decided to fully hedge our euro-denominated equities, which make up roughly 25% of our portfolio.

Euro/dollar is trading at 1.17, at the top of its 52‑week range. Much of our return this year has come from dollar weakening, but we now believe the dollar is squarely in the middle of its smile and risks are skewed towards dollar appreciation.

Either the US economy strengthens (read: remains strong), in which case the dollar would probably rise. Or the US economy weakens, in which case a global risk-off sentiment can lift the dollar anyway.

Then there is the potential for more geopolitical stress also supporting the dollar.

What are the scenarios in which the dollar could weaken relative to the euro? Is it possible the US economy could face a significant slowdown without a corresponding slowdown in Europe? Possible, sure. But less likely, in our opinion.

With uncertainty high, we prefer to lock in gains and protect the downside rather than chase more upside.

For those interested in how we’re implementing the hedge, we’re using IBKR to sell short futures contracts. The symbol is M6E with a March 2026 expiration. For more detailed explanations on hedging with futures, see here.

All materials produced by Reveles Research, LLC—whether posted on this site or distributed elsewhere—are supplied solely for information and education. Nothing herein constitutes, or should be construed as, investment, legal, or other professional advice. You should carry out your own analysis and due diligence before acting. Every investment decision ought to reflect your unique financial circumstances, objectives, and tolerance for risk.