Verallia S.A., Part I

A cheap, low-growth glass-bottle maker with rising margins and a high yield.

“Buy on the cannons and sell on the trumpets.” — French proverb.

Verallia, a French company, is the third largest producer of beverage and food glass packaging in the world and the leading producer in Europe. It also has a strong presence in Latin America, but no operation in the US besides a sales office.

In short, Verallia owns and operates 63 glass furnaces which produce standard or customized bottles and containers for a variety of end-markets.

At first glance this might sound like a very boring company, but there are three things that I find fascinating about the competitive nature of the industry:

Transportation - Because glass bottles are relatively low value, heavy, and fragile, transporting them over long distances is costly and impractical. This means that competition among producers is mostly a regional affair. A furnace in Cognac, for example, competes with two others in the vicinity. If supply is scarce, it might compete with furnaces further afield, like in Toulouse or Chateauroux. But it will never1 compete with furnaces in Poland or, say, China. Physical distance greatly limits the competitive universe Verallia is part of.

Energy - Halting and then resuming production—cooling down a furnace and reheating it to the extreme temperature of approximately 1500°C—jeopardizes the structural integrity of the walls and related machinery. As a result, all furnaces must be kept running continuously, and the high energy cost this requires (~30% COGS) becomes a fixed cost—it doesn’t vary with production volume. High fixed costs deter competitors seeking to break into the local market2, as they would first need to secure substantial production volumes in order to realize any profits.

Raw material - Producing glass from primary raw materials like sand and soda ash is costly. However, using recycled glass, or cullet, significantly reduces these costs. Cullet melts at a lower temperature, thereby saving energy, and often costs less than virgin materials. Access to cullet can lead to lower overall production costs. For new entrants, securing a reliable and ample supply of cullet can become an obstacle as it requires investing in collection and processing infrastructure, which entails time and greater upfront investments.

Transportation, energy, and raw materials make up most of cost of sales. Each of them, in their way, protects the incumbents in their local markets and raises the threshold against new entrants.

i. Revenues

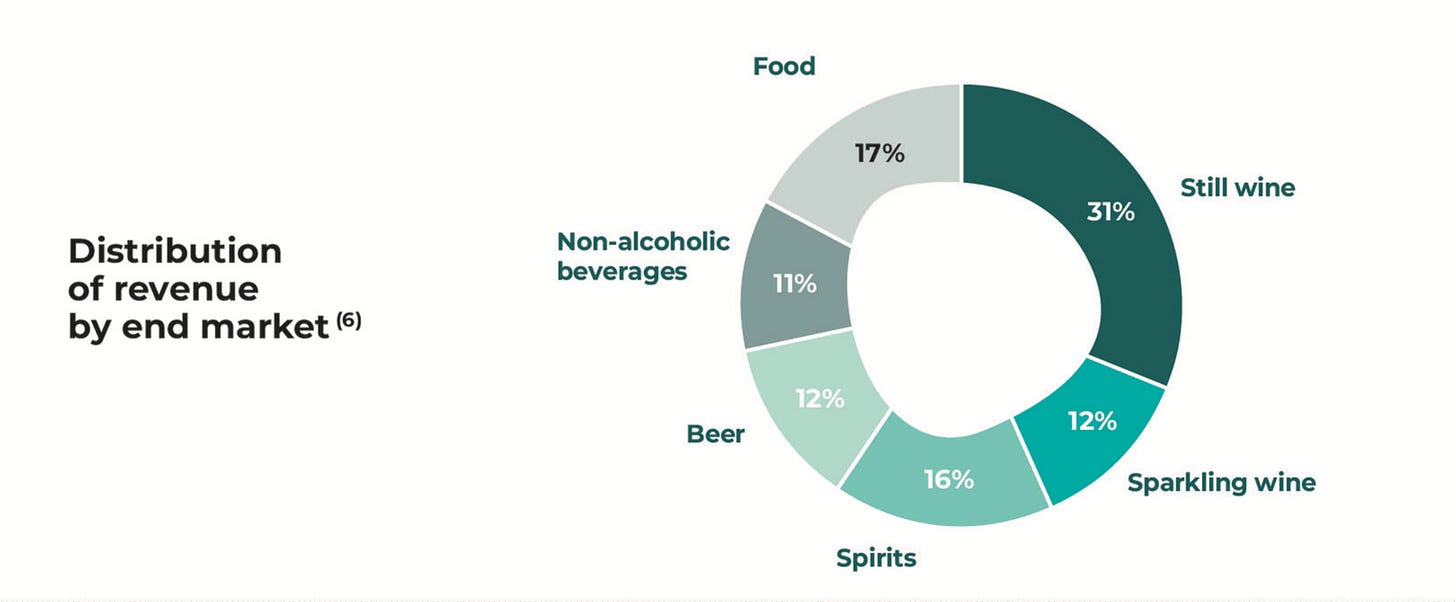

Globally, Verallia’s revenues break down into the following categories:

The distribution of its customers varies by region.

In France, Italy, Spain, Chile and Argentina, the predominant customers are wine-makers. The wine market is characterized by a high degree of fragmentation and a significant dependence on foreign demand.

Operations in Germany and Brazil are mostly oriented towards bottles for beer, which—along with food & beverages—is a more consolidated market.

In the UK, the proportion of spirits has notably increased since the acquisition of Allied Glass, now Verallia UK, in November 2022.

In the past five years overall volumes have come down but prices have kept up with and even exceeded inflation.

This is because, despite lower volumes, Verallia aims for a positive “inflation spread” (where selling prices exceeding production costs) as a core pricing strategy. We’ll get to this later.

For the moment, let’s look at volumes.

In 2016, the earliest year for which we have data, Verallia sold 5,448 kilotons (kt) of glass bottles.

In 2023, it sold 5,568 kt.

While not explicitly stated, it's likely that these figures are inorganic. Considering acquisitions (Allied Glass in the UK and a furnace in Italy), volume over the last eight years was stagnant or possibly declined slightly. Given this pattern, there's no strong basis to expect a change in trend moving forward. It seems probable that Europe has reached its maximum production capacity for wine, beer, and spirits.

[According to FEVE, a trade organization, production volume in the same time period (2016-23) for the overall European glass food & beverage market increased by about 0.3% CAGR, which corroborates our thesis.]

So it’s probably safe to assume overall volumes will be flat going forward. However, there are factors that could potentially cause a deterioration.

In the short or medium term, the most significant risk arises from potential tariffs on the European wine & spirits industry, which could be imposed by either China or the US, impacting demand.

Looking further ahead, the greatest long-term threat comes from global warming, which, in one way or another, could impact crop yields.

I believe China doesn’t actually wish to implement any punitive tariffs, as it stands to gain little from doing so. Instead, it would prefer to maintain the threat as a means of cautioning European regulators. The moment tariffs are enacted, China's leverage diminishes.

The tariffs themselves are purely reactionary and are not intended to protect a Chinese national wine industry (which doesn’t exist). Consequently, once enforced, they offer little benefit to China. Therefore, we anticipate that a compromise is far more probable.

The US, on the other hand, is more likely to follow through under a Trump presidency. Trump already imposed a 25% tariff on wines in 2019 (later suspended by Biden). It’s not hard to imagine him re-imposing it.

ii. De-stocking in 2023 and ’24

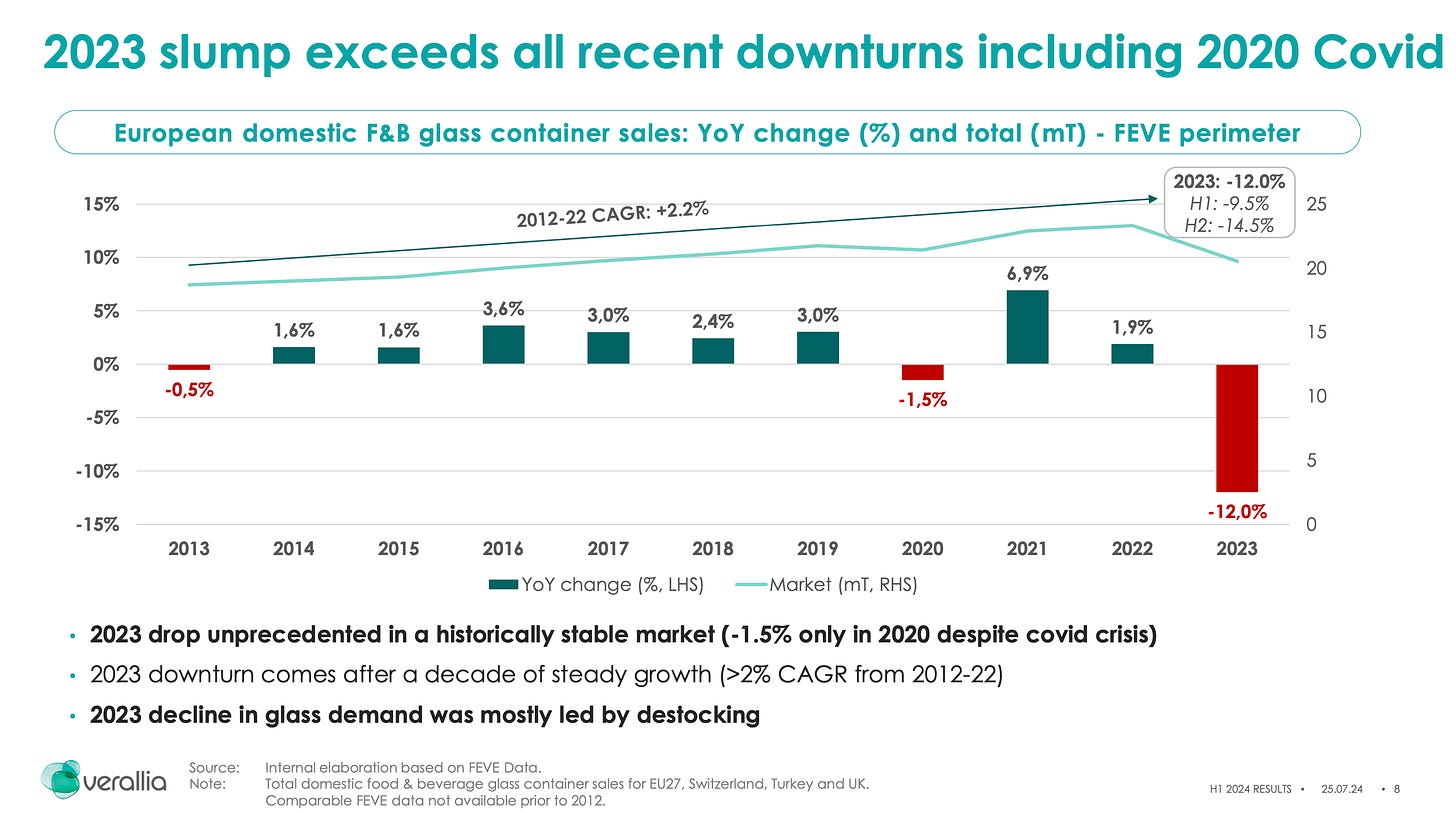

Here’s CEO Patrice Lucas explaining the post-Covid situation while referencing the following slide (with volume data coming from FEVE for the overall European glass food & beverage market3):

In 2021, post-Covid, we faced strong growth due to high-end demand. The glass market [by volume] went up by 6.9%. We were running production at maximum…

Then beginning of ‘22 demand was again high, and the conflict in Ukraine disrupted the supply chain. Many of our customers were afraid of not getting their glass packaging go to do their own business…

And finally in 2023 it was a totally different story—impacted by two years of high inflation in Europe, unprecedented for the past 40 years. And with the context of high interest rate. So the glass market went down by -12% [by volume]…

The de-stocking story is a familiar one, experienced by just about every industry. In an attempt to secure enough supply, Verallia’s customers over-purchased during the boom years and now are placing fewer orders for glass bottles as they work through excess inventory.

1H 2024 saw a continuation of this volume decline, with recovery taking longer than expected. In our view, this adjustment phase presents a great opportunity as it seems likely that markets will eventually stabilize and return to more typical demand levels.

iii. The Spread

Beyond volume growth, Verallia concentrates on two additional performance indicators to drive sales and enhance EBITDA:

Positive Inflation Spread: This strategy aims to raise selling prices at a pace that meets or exceeds the increase in production costs (before any effects from the Performance Action Plan, detailed below).

Performance Action Plan (PAP): This strategy centers on improving operational efficiency through cost-reduction initiatives within Verallia's production. The goal is to achieve a minimum annual reduction of 2% in cash production costs through this program.

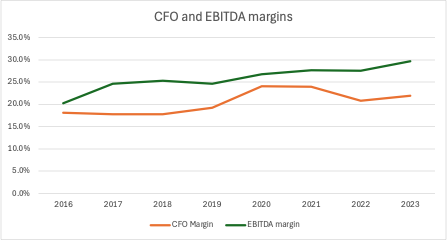

Verallia has been more successful in these areas than in trying to increase volumes. From 2016-23, sales increased at 8.5% CAGR, driven by price increases (if including LTM June 24 this figure would be closer to 6%).

Below we’ve plotted the CFO and EBITDA margins. Over the past seven years, CFO margin improved by 600 bps while EBITDA margin saw a quicker increase, rising by 1,000 bps—the recent divergence being partly attributed to Verallia’s own inventory buildup (which affects cash but not revenues).

iv. New Capacity

We believe one of the reasons Verallia has been able to successfully improve its margins is due to the fragmented nature of its wine & spirits customers (with whom most of their contracts renew annually) and the various factors that limit competition, as previously mentioned. To sustain this progress, it's crucial to monitor any new supply that may enter the market in the coming years.

Furnaces generally take 18 to 24 months to build, providing investors ample time to respond to new supply introductions.

Verallia’s main competitors are:

Ardagh Group is a private company supplying metal & glass beverage cans mainly in North America, Brazil, Europe, and Africa. It competes with Verallia mainly in Northern Europe, where it has 21 glass production facilities, see map below (green dots only). For comparison, their EBITDA for glass packaging was $543 mn (in Europe & Africa segment) vs Verallia’s 270 mn (in Northern Europe segment).

Ardagh has one new hybrid furnace coming online in Germany in 2024, with nothing else planned in Europe for the future.

O-I Glass competes with Verallia in Europe and Brazil. In Europe, it has 34 production sites with EBITDA of $848 mn (Europe segment) vs Verallia’s $1,071 mn (Northern and Southern Europe segments)

O-I is undertaking a significant greenfield CapEx project named MAGMA in the US, which emphasizes smaller, more agile, and geographically dispersed facilities:

“The Company has increased its focus on advancing melting technology… [which] seeks to reduce the amount of capital required to install, rebuild and operate its glass manufacturing lines. The new glass manufacturing technology is also focused on the ability of these assets to be more easily turned on and off or adjusted based on seasonality.” (from O-I’s 2023 Annual Report)

Here’s a video explaining the concept:

Personally, I am unable to confirm the validity of the claims made about this new system. I’m skeptical since any mention of it is so light on specifics, but it bears monitoring. Their plant is scheduled to start production in August of this year in Kentucky, US. They have nothing planned for Europe.

Vidrala has 8 production sites across Spain, Brazil, and the UK (estimated global EBITDA of about $410 mn). This year, it sold a furnace in Italy to Verallia.

Vidrala has no new furnaces planned or under construction.

Vetropack has 12 production sites across central and Eastern Europe. EBITDA for the group in 2023 was $196 mn.

In 2023 it opened one new furnace in Italy but it will be shutting down a furnace in Switzerland. No other projects are planned.

All in all, it seems to be a very stable market. Low volume growth is not necessarily a bad thing, as it disincentivizes new investments. The value with a company like Verallia lies in its ability to expand margins.

We’ll be following up soon with another post on Verallia’s dividends & buybacks, valuation, and conclusions—but suffice it to say that we are very excited about this company! Ciao for now.

The content provided by Reveles Research, LLC, including all materials on this website and in any other communication from its author, is strictly for informational and educational purposes. It is not intended to be, and should not be interpreted as, investment, legal, or any other type of advice. Readers are encouraged to conduct their own research and due diligence. It's important to remember that investment decisions should be tailored to an individual's specific financial situation, goals, and risk tolerance.

Because of supply shortages in 2022, some customers did buy from China, but at high costs. Here’s Ardagh Group, one of Verallia’s competitors, in their 2023 earnings call: “What you have with some of our bigger customers particularly on the liquor side last year at the end of '22, they were very annoyed with us that we couldn't give them bigger allocations for 2023 than what we were able to give them. And they bought glass inventory from outside the normal channels, from Middle East and places like that and even some from China, which was pretty expensive for them. But they had it there.”

According to Ardagh Group: “Ardagh Glass Packaging’s variable costs have typically constituted approximately 40% and fixed costs approximately 60% of the total cost of sales for our glass container manufacturing business.” (2023 Annual Report)

Keep in mind that volume CAGR is calculated without including 2023—which to me is a bit misleading as it doesn’t capture the full business cycle.